A student loan interest enables a person to get a tertiary school education. You must be aware that the borrowed means can make it hard to pay off. It can cause stress as the interest keeps getting greater and greater. In such situations, the government took the stand to make student life more manageable by launching the student loan interest deduction system. It helps decrease the stress of financial costs while pursuing higher learning. Further, student loan interest deduction deduct some amount from the tax interest. This helps to reduce the loan paying off responsibility.

Learning what a student loan interest deduction is.

The Internal Revenue Service ( also known as IRS ) has introduced the student loan interest deduction. They are helping those needing help completing their studies due to financial reasons. This assists in decreasing your tax through the student loan interest. The loan can be utilized for anything regarding education.

Acceptable standard

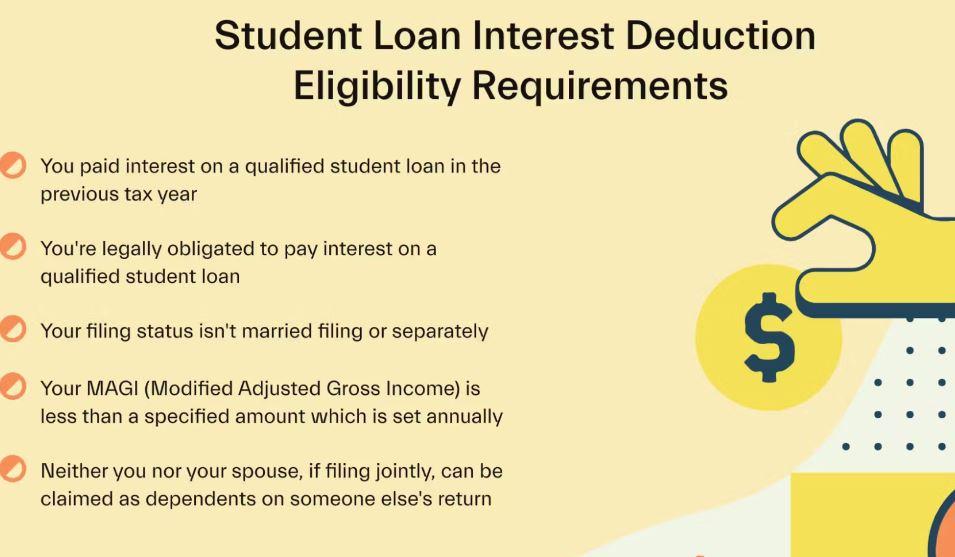

It is different from anyone who is eligible for taking this advantage. One has to go through a few steps to be appropriate for acceptance.

Stature: it is essential to write whether you are single, married, or widowed while filing the request.

Limitations: it is not like the amount of deduction is fixed. This is a system called MAGI ( Modified Adjusted Gross Income). Your income should be under a specific number to meet the deduction criteria. It is an element of the deduction system that your income is below the amount. Otherwise, if your income starts to grow higher and crosses the prescribed number, the deduction will soon disappear.

Sort of loans: Qualified student loans are the only ones that can get accepted for the deduction. It is a must that the purpose of it is only related to learning, such as pursuing education and being independent.

The amount of deduction

The most recent update happened in 2022. According to it, a person can benefit from a deduction of $25,000 through a student loan. It can change over time. So ensure that you are well connected with the update. So that you are aware of any new changes, if they ever happen, remember that the deduction is not applied to the total loan amount. Instead, it focuses on the original sum of paid interest.

What is meant by qualified student loans

You must know that the loan should only be taken for educational purposes. Anything related to education is included. In advance, there are a variety of loans, such as private loans, federal loans, and more. One should be left with half of his school life to avail of these loans.

Certified schooling expenditure

Here are a few reasons to qualify for the student loan interest deduction.

Institution fee: The amount needed to pay the fee of any Institute by which you are receiving the education. This is included in the educational expenses.

Classroom material: One needs stationery such as a pencil, pen, book, and much more for their study. The student interest loan can take all these.

Transportation: To Reach the institutes, one has to pay for transport.

Living: The cost of living when you live far from your house for educational purposes.

The process for grabbing hold of the deduction

Higher learning: It is a must that the loan is being used for education, like things involving learning, such as buying books, paying institute fees, etc.

Stature: A requirement is that the borrower has only gone through half his educational years.

How can I get the deduction?

To get a claim for the deduction. One has to go through a few of the procedures. Let's take a look at those.

Paperwork: a few necessary documents are required in the procedure. The rhetoric loan servicer will help you get the 1098-0 form. It is an essay element because, at the time of the tax year. This form highlights the student loan total interest paid. Ensure that you have piled up each document required or asked for.

The sum of the deduction:

- Remember to understand what the 1098-E form says.

- Look at it and identify the amount of deduction for yourself.

- Remember that $25,000 is the highest amount for the deduction one can avail.

Return of the tax: After taking the time to understand the information and determine your amount of deduction, It is time to add it up in the tax return as prescribed in the area of the paper. You can act upon their guidance or ask for help if you struggle with another process.

Restrictions

At one side. When enjoying the beautiful advantages of the student interest loan deduction. Ensure that you are updated with the rules and restrictions that come your way. Knowing the limitations is an essential part of the process. Be familiar with the MAGI system before taking the steps. Once you have hit its limit, the deduction will soon vanish over time. On the other hand, the married couple must undergo a different procedure. The MAGI system will be different for the couples.

Pointers that can help to enhance the deduction

Be updated: To avail of the benefits, keep checking the updates. Keeping yourself updated helps you come across new changes. This way, you can maximize your experience and can avail further benefits.

Be on time: As we all know, a terrible expression can be incredibly awful. And can be a reason for the appearance of the difficulties. So, for the excellent site. Remember to pay the student loan at the time they ask. It is better to attend the prescribed date. If you submit the load payment late, a lousy step could be taken on your sustainability of deduction. So it is better to pay them timely.

Keep checking on further alternatives: During the procedure, keep an eye on supplementary options. There can be the possibility of meeting up with such advantages. That can suit your situation in a more significant manner. While the student interest loan deduction can be beneficial for you. There can be more opportunities similar to deductions or tax credits. Through digging up for them, you can come up with several other solutions for the financial problems you have been facing.

What are the benefits?

Students need help with pursuing the proper education. The student loan interest deduction works to provide a source of availing the advantages. These advantages help to deduct some income from the loan. We are helping them with the stress by giving them the chance to reduce the amount of loans taken to pursue higher learning. Many students make use of this opportunity to meet education expenses.

Final words

Student loan interest deductions are a lifesaver for multiple individuals. The education journey may become more accessible for those facing difficulty in pursuing higher learning. It gives fun and support to the students, relieving them. Remember the limitations and meet up with the requirements. The person can make the right decision for themselves. Once everything is done, check the tax enrollment time and take action when it arrives. If you need any help with the tax procedure, you can ask for guidance from an expert. In addition, remember to keep yourself updated with the new changes.