The decision to when you file bankruptcy what happens is fraught with legal, financial, and emotional complexities. In this legal process, the debts of a person or company are either discharged or repaid with the assistance of the court. Consider it if you are drowning in debt and see no way out except bankruptcy. Chapter 7, Chapter 11, and Chapter 13 bankruptcy each have their own qualifying criteria, benefits, and drawbacks. Before filing for bankruptcy, discussing things with a knowledgeable legal professional is wise. The effects of bankruptcy on one's credit, financial prospects, and personal life may be devastating. It's crucial to weigh the costs and advantages of filing for bankruptcy before making a final choice.

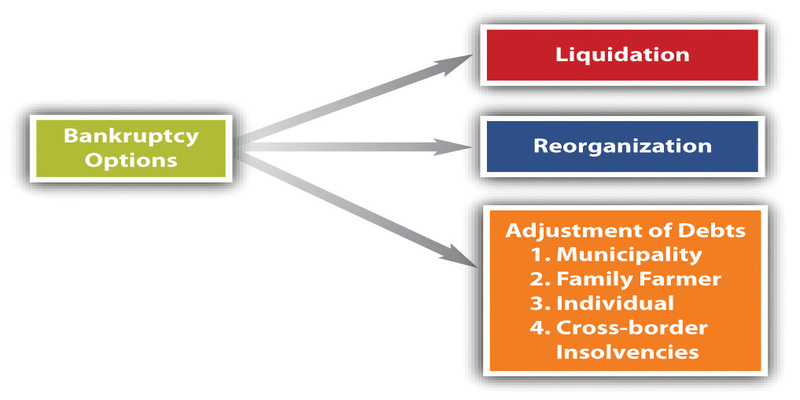

Types Of Bankruptcy

Chapter 7 Bankruptcy

The most common type of personal bankruptcy is Chapter what happens when you file chapter 7 bankruptcy, sometimes known as liquidation bankruptcy. The debtor's nonexempt assets are liquidated in Chapter 7 bankruptcy to repay unsecured creditors. The debtor is released from all outstanding obligations, with a few notable exclusions, including some types of school loans and taxes.

Chapter 13 Bankruptcy

Chapter 13 bankruptcy, commonly called a "wage earner's plan," is a kind of bankruptcy that allows people with a regular income for three to five years to pay off their debts. Under Chapter 13 bankruptcy, the debtor can retain some or all of their property in exchange for an agreement to make monthly payments against the obligations.

Chapter 11 Bankruptcy

Businesses that are drowning in debt often turn to Chapter 11 when you file for bankruptcy what happens as a last resort. Under Chapter 11 bankruptcy, the company keeps running even while its debts and operations are reorganized. A company's proposed restructuring plan must be accepted by its creditors and the court before it can proceed.

The Bankruptcy Process

Pre-Filing Counseling

Credit counselling with a regulatory body must be accomplished before the bankruptcy filing. The goal of the counselling session is to assist the debtor in assessing their financial condition and deciding whether or not bankruptcy would be the best course of action.

Filing For Bankruptcy

A petition must be filed with the bankruptcy court to declare bankruptcy. Financial details such as the petitioner's debts, assets, income, and outgoings are detailed. An automatic stay is placed after the petition is filed, preventing creditors from taking further action to recover the debt.

Meeting Of Creditors

The meeting of creditors often takes place within a month of the petition being filed. It is expected that the debtor will show up to the forum and answer inquiries regarding their finances. Debtors must allow creditors to interview them about their money.

Bankruptcy Discharge

If the bankruptcy court grants the petition, the debtor is freed from responsibility for paying any remaining balances. Usually, this happens in Chapter 7 bankruptcies four to six months after the petition was filed. When debtors finish their Chapter 13 repayment plan, they get their discharge.

Consequences Of Filing For Bankruptcy

Credit Score

A person's credit score will take a hit if they declare bankruptcy. They will have a negative mark on their credit record for up to ten years after the bankruptcy.

Assets

The debtor's nonexempt assets are liquidated in Chapter 7 bankruptcy to repay unsecured creditors. Chapter 13 bankruptcies force debtors to develop a repayment plan that uses a substantial portion of their monthly income. Some property may be lost as a consequence of this.

Employment

Those who have filed for bankruptcy are protected against discrimination in the workplace. Even so, persons with a bankruptcy record may find it challenging to get work in particular fields, such as the banking sector.

Conclusion

It's not easy to consider bankruptcy, but for those with too much debt, it may be their best alternative. Bankruptcy comes in various forms, each with its conditions and repercussions. Declaring bankruptcy is an important life choice that must be given careful consideration. Before filing for bankruptcy, consider your preferences and get expert advice. If you're drowning in debt and can't make ends meet, filing for bankruptcy may be the only option to get some breathing room. Before deciding on bankruptcy, it is essential to learn as much as possible about the procedure, the many types of bankruptcy, and your eligibility for each. Filing for bankruptcy involves several legal and financial factors that may be difficult to manage without the assistance of an experienced bankruptcy attorney.